NEW: We Made the List: America's Top 100 Most Loved Placed to Work

Clean Energy Financing: Unlocking Renewable Energy Growth with Transferable Tax Credits

April 10, 2024

The renewable energy procurement landscape is undergoing a dynamic shift with the introduction of tax credit transferability, making it easier for large and small corporations to support the clean energy economy. With the Internal Revenue Service (IRS) releasing its final guidelines for the tax credit transfer market created by the Inflation Reduction Act (IRA), it's now up to renewable energy companies, financial institutions, and other corporations to evaluate the pros and cons of this latest opportunity for monetizing tax credits to fund decarbonization efforts.

It’s clear that this nascent market has tremendous potential to usher in a new wave of clean energy project development by making it easier for clean energy infrastructure projects to access capital. The appetite for the transferability market is already exceeding expectations, having reached an estimated $7-9 billion within just the final months of 2023, with some expecting the market to triple by the end of 2024.

Keep reading to learn about the origins of this new method for financing clean energy infrastructure and how it compares to traditional tax equity investments.

From Tax Equity Financing to Tax Credit Transferability

For years, the US federal government has offered financial incentives, such as the Investment Tax Credit (ITC), encouraging companies to invest in renewable energy development. However, before the IRA, many entities could not access the value of these tax equity investments because of insufficient tax liability.

This resulted in the creation of a tax equity market that encourages large taxpayers to assist in funding projects. That new market succeeded in supplying clean energy projects with needed capital but disproportionately relied on the largest financial institutions like banks and insurance companies.

The IRA introduced us to a new regime, tax credit transferability; here’s how this new market impacts businesses:

- On the Demand Side

Transferable tax credits make it easier for developers and renewable energy asset owners to exchange credits for cash by allowing them to transfer those credits to a buyer instead of the conventional method of creating a complex tax equity structure.

- On the Supply Side

Transferable tax credits allow more organizations to fund renewable energy projects through tax credits by allowing them to purchase credits in smaller quantities (i.e. a single project can sell credits to multiple buyers) and directly from the project owner instead of through complex ownership structures.

The tax credit transferability landscape is still evolving, but the marketplace is already facilitating broader access to clean energy tax credits with less complex transaction structures than traditional tax equity investments.

Tax Equity Investments vs. Tax Credit Transfers

Tax equity investment structures can have high costs due to their complexity. The tax credit transfer market has already allowed for the entrance of small- to mid-market players in an industry historically dominated by a relatively small number of tax equity investors.

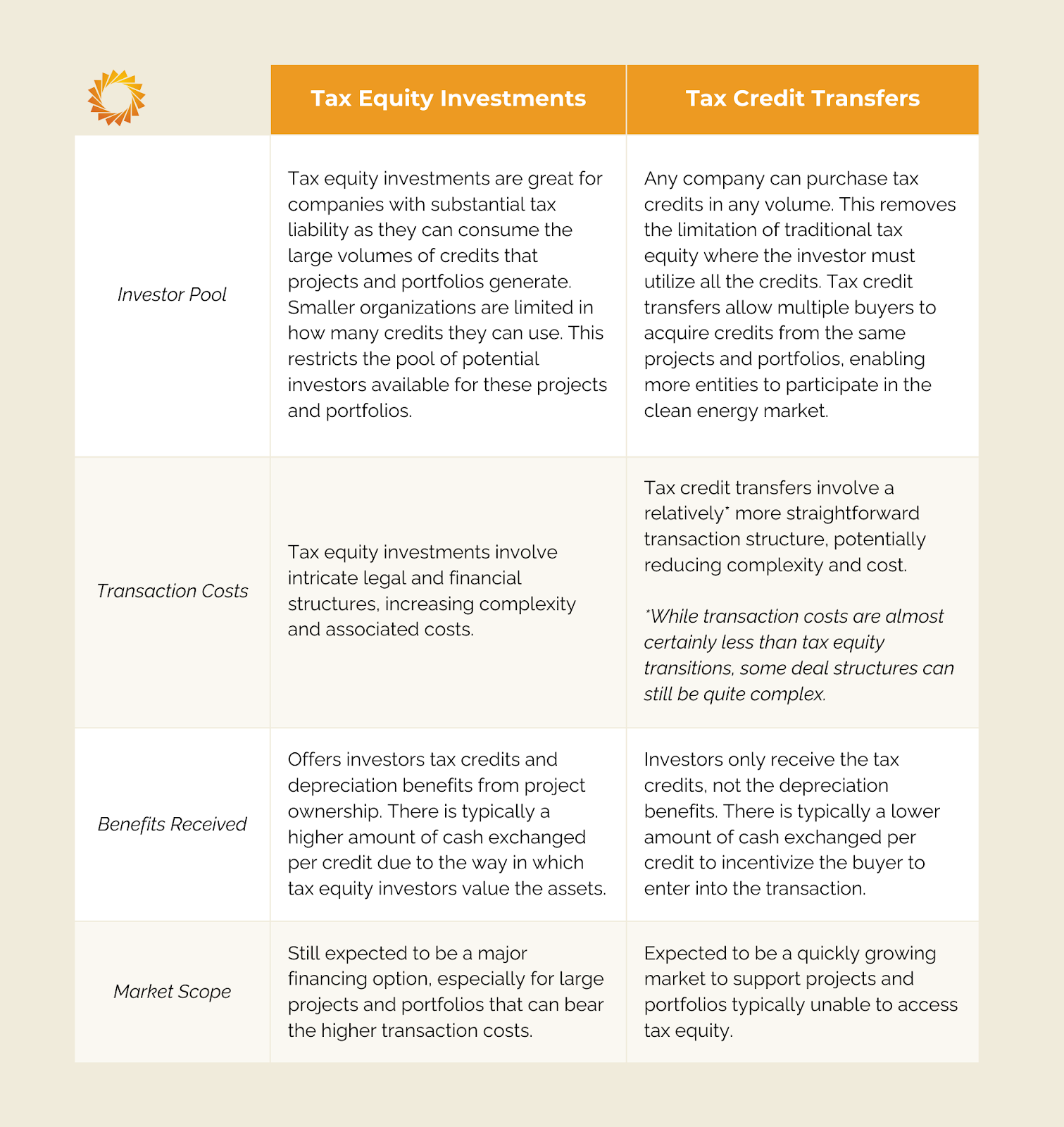

The following chart outlines the key differences between traditional tax equity investments and novel tax credit transfer transactions.

It's important to note that even as the tax credit transfer market grows, tax equity investments will remain a valuable tool for certain projects and investors. Both methods can and will co-exist. Ultimately, each developer and investor will independently determine whether tax equity or transferability makes the most sense for their specific situation.

Navigate Project Financing with an Expert

Navigating the evolving landscape of renewable energy financing requires specialized knowledge and expertise. Although tax credit transfers are designed to be more streamlined and accessible, they are still significant monetary transactions. We recommend working with a trusted and experienced advisor who can help you sift through the nuances of tax credit transferability.