NEW: We Made the List: America's Top 100 Most Loved Placed to Work

How Solar Creates Financial Resiliency For Facility Management Budgets

March 17, 2021

Companies can experience many financial downturns and unanticipated costs. Decreasing demand from tenants, rising competition, and uncertainty in input costs can lead to much variability in the business. This is especially an issue now due to the COVID-19 pandemic, as there is a lot of uncertainty around when people will return to offices, and the occupancy levels will hit a pre-pandemic level.

As a facility manager, your job is to ensure that, despite the setbacks, you continue to maintain and operate the property to the best of your abilities. You can improve your net operations budget and protect your company against risks by adopting solar energy.

To protect your company against risks, it is essential to consider the concept of financial resiliency. Financial resiliency assesses a company’s ability to ride out crises or economic downturns. A financially resilient business can withstand uncertainty instead of being controlled by it.

There are two options commercial customers generally use to get solar panels on their properties: Purchasing the system directly or entering a Power Purchase Agreement (PPA). If your business decides to purchase the solar system, it will directly receive the federal solar Investment Tax Credit (ITC)¹ and other solar energy incentives. This means you would be able to pocket the extra money instead of having a solar developer use it and pass it through to you as a lower electricity cost. Additionally, purchasing a system can sometimes simplify the process of installing solar by removing the need for financing or additional parties that may require credit checks. However, you may need to manage incentive applications or arrange long-term operations and maintenance for the panels themselves.

A PPA is a framework whereby a commercial or residential customer agrees to buy electricity from a solar developer, like Pivot Energy. In return, the developer installs solar panels on the customer’s facility and sells the energy produced by the system to the customer at a predetermined rate. This rate is fixed over the contract’s length (typically 20-25 years), and this is generally lower than the rate the customer is currently paying to their local utility. After the contract expires, the customer has three choices:

- Purchase the solar equipment.

- Renew the contract with the solar developer.

- Remove the system from their property altogether.

Electricity cost uncertainty

The opportunity to lock in the electricity rate is beneficial because it would offer you long-term price certainty, instead of needing to constantly update your facilities budget with the risk of inflating energy prices. In the past decade, utility prices in the U.S have risen by a total of 15%, or approximately 0.2 cents per kilowatt-hour (kWh) each year. While this may not seem like a lot, it adds up over time. For example, if your property uses around 3,000 kWh of electricity per month, your utility bill now is likely much higher than what it was 10 years ago.²

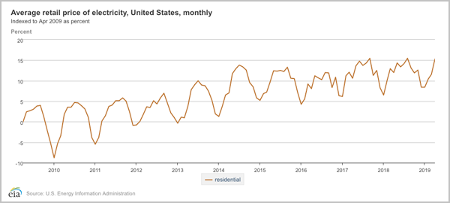

Figure 1: Rising electricity rates in the U.S between 2010-2020

The trend of rising utility rates is predicted to continue for the next couple of decades. According to the U.S Energy Information Administration (EIA), the electricity price will increase at least until 2040³. Changes in the rate reflect fluctuations in fuel costs, growing energy demand, and a lack of availability of nonrenewable generation sources. Increased fuel generation capacity and power plants need to be built to meet this growing demand, potentially causing further price hikes, which will most likely be passed through to residential and commercial customers like yourself.4

Solar as an energy cost hedge

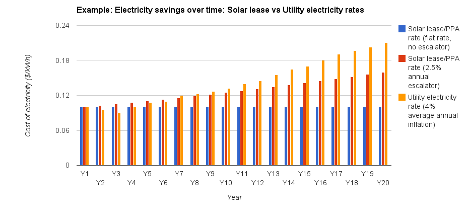

What all of this means is that if you choose to install solar through a PPA, your electricity expenses will likely go down instead of up the next 15 to 20 years. In many markets, solar energy is available at an immediate discount to grid power, plus the rate is locked in over the long term. So, it is entirely possible to have all of these benefits without having to spend a penny installing the solar energy system – a unique opportunity for companies with commercial properties around the U.S.

Even if you were to purchase a system directly, the typical payback period is 5 to 12 years, depending on the complexity of the installation and the cost of grid electricity in the area where your facility is located. The result is a significantly lower electricity bill for the remainder of their solar energy system’s life. The savings each month contribute to your positive return on investment (ROI) for the solar installation costs.

Figure 2: Electricity savings with and without PPA over a 20-year period5

Reduce financial risk with solar

Going back to the idea of financial resiliency, solar PPAs can be an excellent way for your business to reduce risks and protect itself against rising energy prices. By locking in your energy prices, you are simply establishing a financial resiliency net to protect your business over the next two decades. It also frees up budget space for more important aspects of your business, such as capital investments, customer services, or hiring new employees.

For many companies, the incentive to go solar goes beyond energy emissions reduction and energy independence and instead focuses on the cost benefits. Customers in the commercial solar market can now use the unique PPA framework to adopt solar energy with no upfront costs. Even If commercial customers decide to install the solar energy system with cash upfront, they can maximize their benefit from policies, such as the ITC. The outcome is a predictable electricity rate so your company can protect itself from long-term cost uncertainty.

That’s financial resiliency.

Contact Pivot today

Determining which solar energy strategy works for your company can be challenging as there are advantages and disadvantages to consider. The Pivot Energy team is ready to support you in deciding what approach is best to achieve your solar targets. Reach out to speak with a member of our team today!

¹By installing solar, companies can receive a one-time 26% tax credit that can be applied towards their federal corporate taxes.